GST or Goods and Services Tax, is a tax that mixes various indirect taxes being charged by Central and State Governments, which resulted in multiple receipts/payment/compliance being needed for intra and interstate business.

GST may be a comprehensive tax on the manufacture, sale, and consumption of products and services throughout India (except for the state of Jammu and Kashmir), to exchange taxes levied by the central and state governments.

It is levied on both goods and services. The main aim of GST is to centralize taxation for businesses so as to relieve them of the burden of compliance and for better management of their cash and finances. It, therefore, becomes imperative for the economy to shift towards the introduction of Goods and Services Tax.

GST stands for Good and services tax. It is a worth-added tax that is levied on most of the goods and services sold for domestic consumption. The GST has been paid by the consumers but at an equivalent time, it’s remitted to the govt by the companies selling the goods and services. In other words, GST is that the money which is generated by the consumers and revenue for the government. Cascading effects elimination will be the major contribution of GST for the business and commerce.

Mandatory fields a GST Invoice should have:

A GST Invoice must have the following mandatory fields:

- Invoice number and date

- Customer name

- Shipping and billing address

- Customer and taxpayer’s GSTIN (if registered)**

- Place of supply

- HSN code/ SAC code

- Item details i.e. description, quantity (number), unit (meter, kg, etc.), the total value

- Taxable value and discounts

- Rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on a reverse charge basis

- Signature of the supplier

GST Billing Software: There are different advantages of using GST billing software in an organization.

-Creates invoices at ease & manage your inventory effectively.

-Personalises invoices with your company logo and other custom details

-Generate GST compliant invoices

– Download, Print and Share invoices with your customers

– Save time in filing GST Returns by using already prepared invoices

-Record payments for invoices created in the system

-Track payments easily & get paid on time

-Manage stock for items you generate invoices for

-Automatically update stock while you create invoices

-Track available quantity of items in your stock

-Share invoices with customers & track payments

-Track inventory & place orders with vendors on time

-Get real time business view of purchases, sales & inventory

GST Enabled Accounting Software enables accounting and bookkeeping additionally to GST filing. GST filing Software is linked with the account that makes invoices and prepares reports for filing to the GST site.

The GST enabled accounting software may or may not be apt for filing the returns. So, it is important to understand that the needs are in conjunction with the features of the software.

Company Accounting Software can be used if it is already there to file the return.

Invoice Creation is additionally important for the right filing of the return. The software should be ready to effectively fill the invoices. Some software comes with reconciliation tools that enable fast processing of receipts thereby increasing the speed of return filing. In some cases, there are multi-user interfaces that also make it smarter and faster.

Customized GST Invoices:

GST Billing Software enables taxpayers and accounting professionals to form GST ready invoices within minutes. One of the foremost important requirements of GST software is to form bound to get the professional invoices and prepared to line remainders too. The latest GST software should issue invoices that have a record of estimates, ready to share the proposal after the approval of consumers, and convert them into invoices or sales orders.

Advanced Inventory:

Another crucial feature that GST software must have is nothing but automatic updating of inventory. Advanced inventory management should allow users to update the stocks and set the custom prices to induce an accurate view of profit and losses.

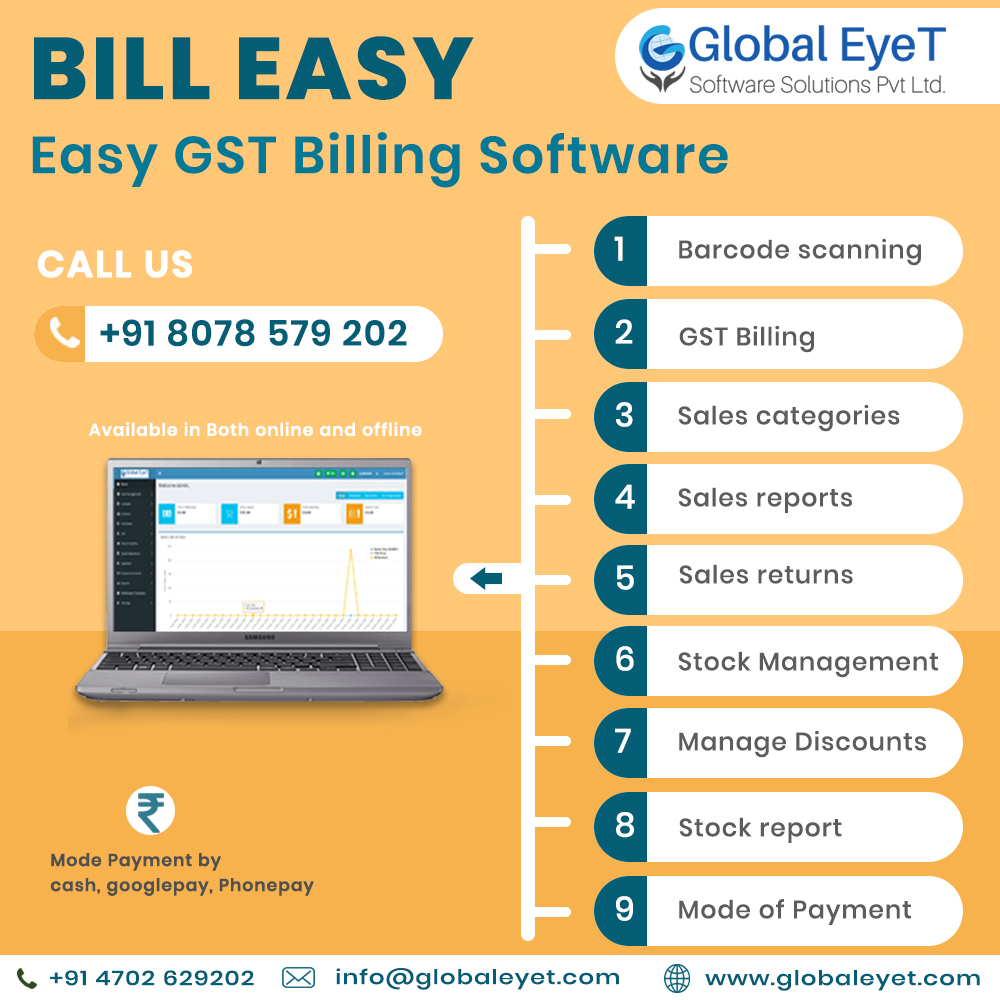

GlobalEyeT billing software contains the following features:

Barcode scanning

GST billing

Sales categories

Sales reports

Sales returns

Stock management

Manage discount

Stock report

Mode of payment

The GST billing & invoicing software comes with a highly effective inventory management system that helps you track down the items in the tiniest details. By using this, you can track complete inventory and all other details by listing them as soon as they arrive. It ensures that all the items you need in the store remain available when required. Using this, you can check the live status of your inventory, set up alerts for new orders, and get detailed information about the same anytime.

Using this, you can have the full inventory controlled by a single employee. Further, keeping track of your inventory makes sure that all the items are in-store and you can get to know when an item is found missing or gets misplaced somewhere.

Another benefit of using software is that you can avoid purchasing unwanted items by understanding your sales reports. It gives you better statistics of your sales and what you need to avoid buying in large quantities. It will help you prepare a plan ahead of time so that you can set up reminders with a better understanding of sales to maximize the profits and minimize expenses.

In a nutshell, an advanced GST software having all the listed features is a must to make your compliances easier that provides GST compliant invoices, automated reconciliation between Sales and Purchase, and also allows you to file your returns timely with just a few clicks. Hope you have got the idea of how reliable software resolves all of your accounting queries and saves some time by automating everything.